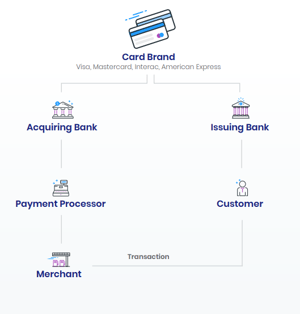

The key players in the payments industry

As a consumer, you know who Visa® (“Visa”) and Mastercard® (“Mastercard”) are, but you have likely never dealt with them directly because your bank takes care of that. As a merchant, it’s important to know all the different players in the payments industry and how each player is involved in processing your transactions; especially those who profit from your sales.

Let’s take a look at the industry and break down where everyone fits in the payment process:

Card Brand (payment brand network or card association)

Common card brands (aka credit and debit card companies) are Interac® (“Interac”), Visa, and Mastercard. They are in charge of overseeing payment processing activity, monitoring the settlement of transactions and clearing of sales, as well as regulating and managing their corresponding compliance policies.

Issuer (issuing bank)

An issuer is a bank or financial institution that offers credit and issues credit cards to consumers on behalf of the payment brand networks. These are specifically the banks that would appear on credit cards, for example, Scotiabank® (“Scotiabank”) (Scotiabank Visa).

Acquirer (acquiring bank)

An acquirer is a bank or financial institution that permits a merchant the right to process credit and debit transactions

Payment Processor (merchant account providers, merchant service providers, independent service organization, ISO)

A payment processor works with acquiring banks to open merchant accounts, handle payment support, and manage credit and debit processing for merchants. Processors can be ISOs such as Zomaron or acquirers such as Elavon.

However, your business is unique, and the ways in which your payments are accepted and the ways you can get charged for accepting payments are very customizable. And therein lies the problem. Many processors will offer discounted rates and fixed costs, without having an understanding