When you’re setting up your business, it can be an overwhelming process to make sure you’re not missing a critical step. One of the things you’ll definitely need is a trusted merchant services provider (like us) to make accepting payments easy.

But, even that’s not always easy. Understanding security (what the heck is PCI compliance?), fees, and above all, pricing models can be tricky.

To make things simple, we’re going to lay out the basics of flat rate pricing versus interchange plus (cost plus) pricing, and help you understand what option is the best fit for you and your business.

What is it?

Flat rate pricing is when you pay the same processing cost for every credit card transaction, regardless of the different interchange rates for different credit card types (debit cards are charged a small per transaction fee).

What do you pay?

You pay a fixed percentage on each transaction, plus a per transaction fee.

Example: If you made $100 and did 5 transactions, here’s what you would pay.

2.6% + 5 cents per transaction

= $100 x 2.6% + $0.05 x 5 transactions

= $2.60 + $0.25

= $2.85

Benefits

*Interchange rates are higher for card-not-present transactions (virtual terminal, eCommerce, mail and telephone) because of the higher risk for credit card fraud.

Drawbacks

Who is it best for?

What is it?

Interchange or Cost Plus pricing is when your interchange percentage rate differs based on the card brand and card type used. For instance, Visa or Mastercard charge different interchange rates based on card brand and tier of card used (premium rewards cards have a higher rate than a basic credit card with no rewards).

What do you pay?

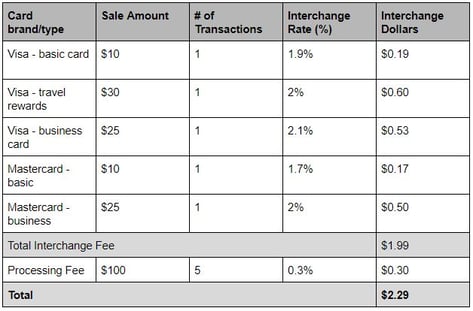

You pay different rates for the different cards and card brands used, as well as the markup for the processor’s services. Since the interchange rate depends on the card brand and type used, you might see 10 different percentages on your bill.

Example: If you made $100 over 5 different transactions, with customers using 6 different card brands and types, your bill might look something like this.

Benefits

Drawbacks

Who is it best for?

Still not sure which pricing model is best for you? We can help you find the right fit for your business.

But first, why not check out some smart terminals with features to help streamline your business?